Consumer neo-banking platform Niyo has raised $100 million in a Series C funding round at a time when consumers are increasingly turning to these platforms for accessing banking services.

This is Niyo's largest fundraise till date and comes almost three years after its Series B round in July 2019. The current funding round was led by Accel & Lightrock India with participation from Beams Fintech Fund. Existing investors Prime Venture Partners, JS Capital are also participating in this round along with others.

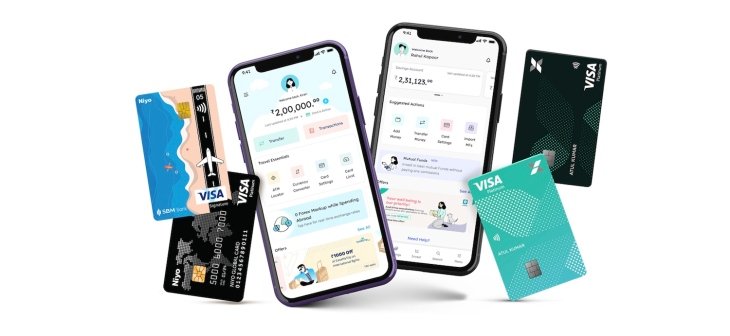

Founded by Vinay Bagri and Virender Bisht in 2015, Niyo offers digital savings accounts, wealth management services including mutual fund investments, prepaid cards and other banking services in partnership with banks. The startup's partner banks include SBM Bank, Equitas Small Finance Bank, DCB Bank, Yes Bank and ICICI Bank.

In its next leg of growth, the platform is looking to begin lending to consumers.

In an interview, Bagri who is the co-founder and CEO of Niyo said, "Lending will complete our stack. We already have wealth management and banking services, lending will make us a complete financial services provider."

Neobanks can be seen as a technological layer over traditional banks with a completely digital presence. Banks partner with players like Niyo to grow their presence digitally, which can help increase customer acquisition faster than growing their physical presence.

Niyo is also looking at securing a non-banking finance company (NBFC) licence and in the second half of 2022 the company will look at offering insurance to its customers as well.